Learn how Sure Wealth Solutions offers a revolutionary approach to guaranteed retirement income without market risks.

Imagine a retirement where your income is as predictable as the sunrise. No anxious mornings checking stock prices, no fear of market crashes wiping out your savings. This isn’t a far-fetched dream—it’s the reality for those who have discovered the power of private pensions, particularly the innovative approach offered by Sure Wealth Solutions.

In today’s financial landscape, traditional retirement plans are increasingly unreliable. The volatility of the stock market, combined with the disappearance of company pensions, has left many retirees vulnerable to financial instability. The 2008 financial crisis and subsequent market fluctuations have shown just how precarious retirement savings can be when tied to Wall Street’s unpredictable whims.

But there’s a solution that brings back the security and peace of mind that retirees deserve: private pensions. And among these, the Sure Wealth Way stands out as a beacon of financial stability and growth. Let’s delve into the world of private pensions and discover why Sure Wealth Solutions’ approach is revolutionizing retirement planning for high-net-worth individuals.

Understanding Private Pensions

Private pensions are retirement plans that provide a guaranteed income stream during your retirement years. Unlike traditional pensions, which are typically offered by employers, private pensions are individual arrangements that you can set up independently of your workplace.

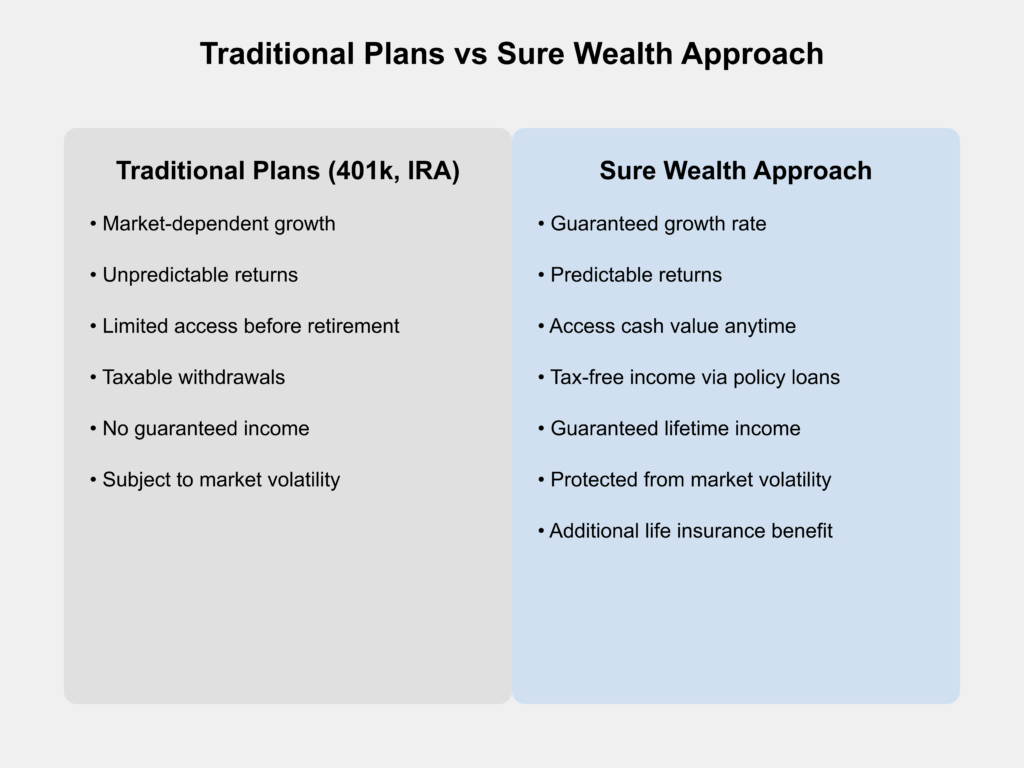

The key difference between private pensions and more common retirement vehicles like 401(k)s or IRAs is the element of guarantee. While 401(k)s and IRAs are investment accounts subject to market fluctuations, private pensions offer a contractually guaranteed income, providing a stable financial foundation for your retirement years.

This guaranteed income is particularly crucial in today’s economic climate. According to a study by the Center for Retirement Research, running out of money is the number one concern for retirees. Private pensions address this concern head-on by ensuring a consistent income stream that lasts as long as you do.

Advantages of the Sure Wealth Way

Types of Private Pensions

There are several types of private pension options available, each with its own set of features and benefits:

- Annuities: These insurance products provide a guaranteed income stream in exchange for a lump sum payment or series of payments. While annuities can offer stability, they often come with high fees and limited flexibility.

- Cash Balance Plans: These are a type of defined benefit plan where an employer credits a participant’s account with a set percentage of their yearly compensation plus interest charges. While they can provide guaranteed benefits, they’re typically only available through certain employers and may lack individual control.

- Sure Wealth’s Approach: Whole Life Insurance as a Private Pension: This innovative strategy uses specially structured whole life insurance policies to create a private pension that offers guaranteed growth, tax advantages, and unparalleled flexibility.

Benefits of Private Pensions

Private pensions offer several key advantages that make them an attractive option for those seeking financial security in retirement:

- Guaranteed Income: The hallmark of private pensions is the assurance of a stable, predictable income stream throughout your retirement years. This eliminates the stress of market volatility and ensures you can maintain your lifestyle regardless of economic conditions.

- Tax Advantages: Many private pension arrangements, including the Sure Wealth approach, offer significant tax benefits. Growth within the policy is tax-deferred, and income can often be accessed tax-free, maximizing the efficiency of your retirement savings.

- Protection from Market Volatility: Unlike traditional investment accounts, private pensions are not directly tied to stock market performance. This insulation from market swings provides peace of mind and stability, especially during economic downturns.

- Legacy Planning: Private pensions, particularly those structured using whole life insurance, can be powerful tools for creating a lasting financial legacy for your heirs.

The Sure Wealth Way: A Superior Private Pension Solution

While all private pensions offer some guaranteed income, the Sure Wealth Way stands out as a superior solution, particularly for high-net-worth individuals seeking security and growth.

At the core of the Sure Wealth approach is the strategic use of dividend-paying whole-life insurance policies. These policies are carefully structured to maximize cash value growth while providing all life insurance coverage benefits. Here’s how it works:

- Guaranteed Growth: The cash value within a whole life insurance policy grows at a guaranteed rate, regardless of market conditions. This means your retirement savings increase steadily and predictably year after year.

- Dividend Potential: On top of the guaranteed growth, policies from mutual insurance companies have the potential to earn dividends. While not guaranteed, many top-rated insurers have consistently paid dividends for over a century, even during major economic downturns.

- Tax-Advantaged Growth and Income: The growth of your cash value is tax-deferred, and when structured correctly, income can be accessed tax-free through policy loans. This tax efficiency can significantly increase the effective yield of your retirement savings.

- Flexibility and Control: Unlike many traditional pension options, the Sure Wealth approach gives you complete control over your money. You can access your cash value anytime, for any reason, without penalties or restrictions.

- Self-Banking Concept: One of the most powerful aspects of the Sure Wealth Way is the ability to become your source of financing. You can borrow against your policy’s cash value to fund major purchases, investments, or business opportunities, all while your policy continues to grow as if you never took the loan.

- Death Benefit: Besides serving as a private pension, your policy substantially benefits your heirs, creating an instant estate and legacy.

This combination of features makes the Sure Wealth approach a formidable and comprehensive financial strategy that provides growth, security, and legacy planning in one powerful package.

Case Study: The Johnson Family’s Secure Retirement

To illustrate the power of the Sure Wealth approach, let’s look at the case of the Johnson family.

Background: Mark and Sarah Johnson, both 55, were nearing retirement with a substantial 401(k) balance. However, after witnessing their friends’ retirement savings take a significant hit during the 2008 financial crisis, they were increasingly worried about market volatility affecting their own retirement plans.

Solution: After consulting with Sure Wealth Solutions, the Johnsons decided to implement the Sure Wealth Way. They used a portion of their savings to fund a specially designed whole life insurance policy that would serve as their private pension.

Outcome: Five years into retirement, the Johnsons are thrilled with their decision. Their policy has provided:

- A guaranteed growth rate of 4% on their cash value, completely independent of market performance.

- Additional growth from dividends, which have averaged an additional 2% per year.

- Tax-free income through policy loans, allowing them to minimize their tax burden in retirement.

- The flexibility to access additional funds for unexpected expenses or opportunities without penalties.

- Peace of mind knowing that their retirement income is secure, regardless of market conditions.

The Johnsons now enjoy their retirement without the stress of market watching, confident in their stable and predictable income stream.

Secure Your Retirement with Sure Wealth Solutions

In a world where financial uncertainty seems to be the norm, private pensions offer a beacon of stability and security. And among private pension options, the Sure Wealth Way stands out as a superior solution, offering not just guaranteed income, but also growth potential, tax advantages, and unparalleled flexibility.

By leveraging the power of specially designed whole life insurance policies, Sure Wealth Solutions has created a private pension strategy that addresses the primary concerns of today’s retirees: outliving their money, maintaining their lifestyle, and leaving a legacy for their loved ones.

Don’t leave your retirement to chance. Take control of your financial future with a private pension strategy that offers true peace of mind. The Sure Wealth Way provides the stability you need with the growth and flexibility you desire.

Ready to secure your retirement income and escape the volatility of Wall Street? Schedule a consultation with Sure Wealth Solutions today. Our expert advisors will show you how to create a retirement income stream that’s as predictable as the sunrise—guaranteed, stable, and designed to last a lifetime.

Contact Sure Wealth Solutions now and take the first step towards a truly secure retirement.